LHDNM - Implementation of e-107D, Tax Payments and Function of Tax Identification Number Search

Lembaga Hasil Dalam Negeri Malaysia (LHDNM) issued the following announcements:

|

1. |

Implementation of e-107D |

|

On 31 December 2024, LHDNM issued a media release stating that starting from 1 January 2025, taxpayers are required to submit the CP 107D Form online via e-107D. Payments for tax deductions under Section 107D must also be made electronically using the Bill Number as follows: |

|

|

2. |

Tax Payments |

|

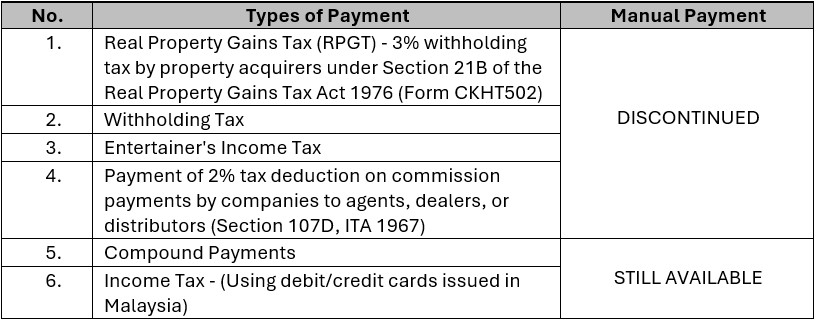

On 31 December 2024, LHDNM issued a media release stating that starting from 1 January 2025, the following manual tax payments services applicable to HASiL KL Revenue Management Centre:

Please click here for further details. |

|

|

3. |

Function of Tax Identification Number Search |

|

On 1 January 2025, LHDNM issued a media release stating that in line with the Budget 2025, LHDNM has introduced a Tax Identification Number (TIN) search service for purposes as stipulated under the Income Tax Act (ITA) 1967 inclusive other tax-related activities, such as implementation of e-Invoicing. The TIN search platform will be accessible starting from 1 January 2025 via MyTax Portal (https://mytax.hasil.gov.my) by clicking on the "TIN Search" menu. Taxpayers can perform a TIN search by entering information based on the following categories: Please click here for further details. |

|